How Much Is Property Tax in California in 2025? A Homeowner’s Guide

If you’re buying property, building housing, or investing in real estate, one question always comes up: How much is property tax in California?

In 2025, that question matters more than ever.

Home prices are rising again in many parts of the state. At the same time, local governments are looking for new ways to fund schools, roads, and services. The result? Higher tax bills—especially if you just bought, built, or renovated a property.

Whether you’re a homeowner, developer, or investor, property taxes affect your bottom line. They don’t just hit you once. They come every year—quietly draining cash if you’re not paying attention.

At JDJ Consulting Group, we help clients across California plan smarter by understanding the full cost of owning and developing property. That includes land use, permitting, and yes—property taxes.

This guide will walk you through how California’s property tax system works in 2025, what average tax rates look like in different counties, and how to estimate your bill before you buy or build. We’ll also share some tools and tips to avoid surprises—and keep your long-term plans on track.

Let’s take a closer look.

Table of Contents

ToggleUnderstanding How California Property Taxes Work

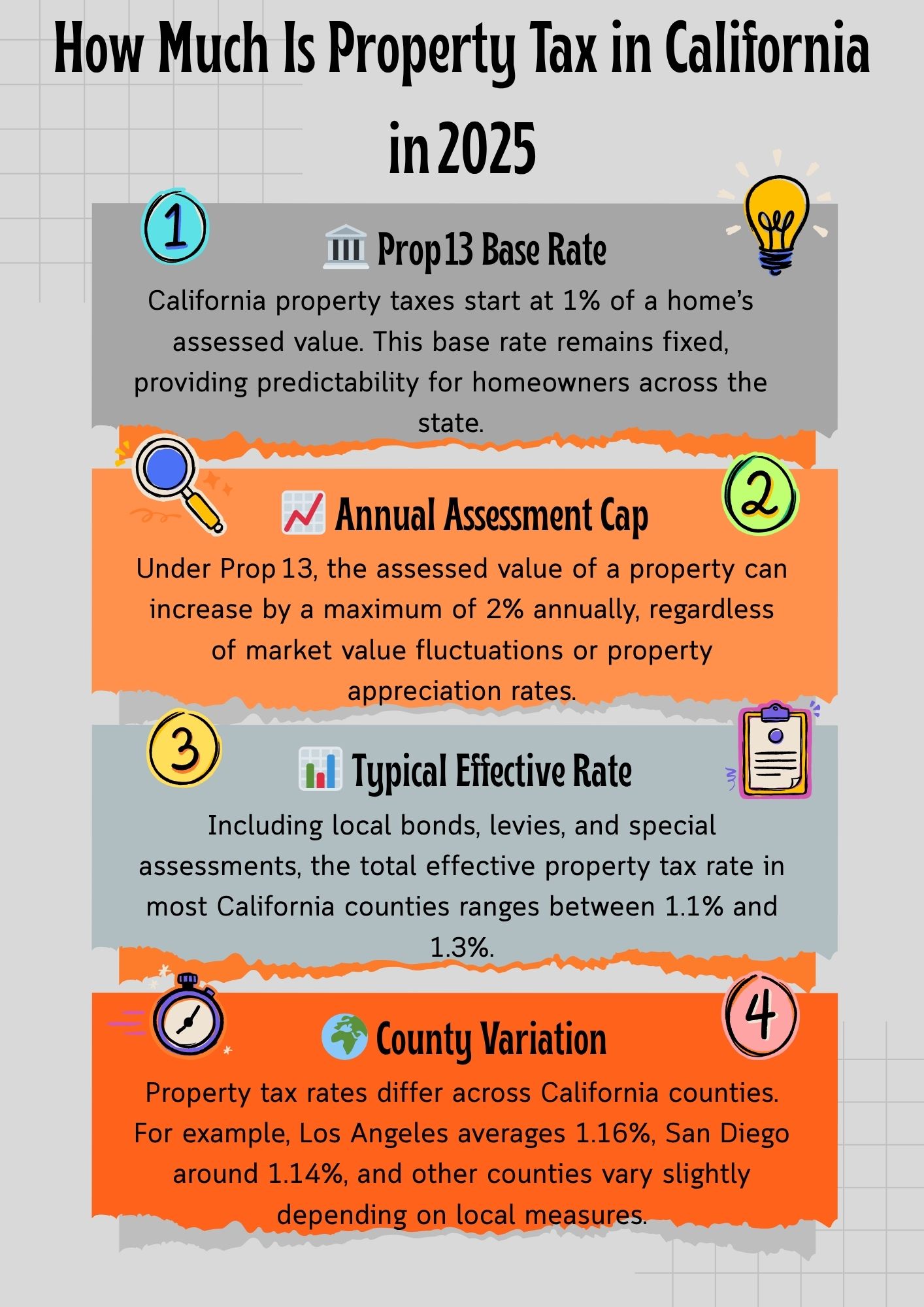

California’s property tax system is shaped by a law passed nearly 50 years ago: Proposition 13. This law limits how much your property taxes can grow over time—making it different from many other states.

The 1% Base Rate (Thanks to Prop 13)

When you buy property in California, the county sets your assessed value based on your purchase price. Then they charge 1% of that amount each year as your base property tax.

So, if you buy land for $600,000, your base tax bill starts at $6,000 a year. That number will go up slowly—because Proposition 13 caps increases at 2% per year, no matter how fast the market value rises.

This rule helps longtime owners. But it can catch new buyers off guard—especially developers or investors who just built or renovated something big.

Tip for Developers: After new construction or major improvements, the assessor will likely raise the taxable value. That means your project will be reassessed at its improved worth—not just the land alone.

When Will My Property Get Reassessed?

While Proposition 13 limits annual increases, some events can reset your assessed value back to the current market price. This is called a reassessment. It usually happens when:

You buy a new property

You transfer ownership (even to family, in some cases)

You add a unit, build a second floor, or make major renovations

For example, if you add an ADU or convert a duplex into a 4‑plex, the county may reassess your property—raising your tax bill in the process.

What Is the Average Property Tax Rate in California in 2025?

The 1% base tax is just the start. Most Californians also pay local taxes—like school bonds, road improvement fees, and parcel taxes. These are approved by voters in each area.

That means your real tax rate could land between 1.1% and 1.3% of your property’s assessed value, depending on where you live or build.

What’s the Difference Between Nominal and Effective Rates?

Nominal rate: The total tax percentage applied to your assessed value (usually around 1.25%).

Effective rate: The actual percentage of your home’s market value you pay in taxes—usually lower, especially if you’ve owned for a while.

Let’s break it down:

| Example | Assessed Value | Market Value | Total Tax Paid | Effective Tax Rate |

|---|---|---|---|---|

| Recent Home Purchase | $850,000 | $850,000 | $10,625 (1.25%) | 1.25% |

| Long-Term Owner | $450,000 | $950,000 | $5,850 | 0.61% |

| New Multifamily Project | $3,200,000 | $3,200,000 | $41,600 | 1.3% |

Note for Buyers & Builders: Always check for extra local taxes—especially in new developments, Mello-Roos districts, or redevelopment zones.

County-by-County Property Tax Comparison in California (2025)

While the state sets the base tax rate at 1%, your actual tax bill depends on where your property is located. Local governments often add special taxes—like school bonds, infrastructure improvements, or fire safety fees. These extra charges vary from county to county.

That’s why two properties with the same value can have different tax bills depending on location.

Here’s a snapshot of what you might pay in different parts of California in 2025:

| County | Median Home Price (2025 est.) | Total Tax Rate (Est.) | Estimated Annual Tax |

|---|---|---|---|

| Los Angeles County | $850,000 | 1.25% | $10,625 |

| Orange County | $950,000 | 1.20% | $11,400 |

| San Diego County | $800,000 | 1.18% | $9,440 |

| Santa Clara County | $1,200,000 | 1.26% | $15,120 |

| Sacramento County | $570,000 | 1.28% | $7,296 |

| Fresno County | $450,000 | 1.30% | $5,850 |

Planning to develop in LA or Santa Clara? Be sure to factor in both the high property values and the added local taxes when running your financial models. These can impact ROI, especially in multi-phase projects.

How New Laws Could Impact Your 2025 Property Tax Bill

California’s tax laws change often—and not just for homeowners. Developers, investors, and estate planners are also affected by state policy shifts. In 2025, one law continues to have a big impact: Proposition 19.

Proposition 19 and the End of Old Inheritance Loopholes

Before 2021, many families could pass down property to heirs without triggering a reassessment. Now, that only applies if the child moves in and makes the home their primary residence. For rental units, inherited second homes, or investment properties, the tax base resets to market value—raising the annual tax bill.

Other Tax Impacts to Watch in 2025

New construction or ADUs: Can trigger partial reassessments

Parcel tax expansions: School districts may add new fees, especially in growth zones

Prop 13 reform proposals: While none passed yet, pressure is building to split-roll commercial properties (taxing them differently than residential)

Developers & landowners: Be mindful of when permits are pulled and construction begins—these often mark the date when reassessment is triggered.

Common Property Tax Questions Californians Are Asking in 2025

Whether you’re new to the market or already own several properties, it’s easy to get lost in California’s tax rules. Here are answers to a few common questions our clients ask:

Do ADUs or renovations increase my tax bill?

Yes. Adding square footage or a new structure will usually lead to a partial reassessment. That means only the new improvements are taxed at current market value—your existing structure keeps its old assessment.

Can I appeal my property tax assessment?

Absolutely. If you believe your assessed value is too high, you can file an appeal with your county’s Assessment Appeals Board. You’ll need evidence like comparable sales or an independent appraisal.

Are there property tax breaks for seniors?

Yes. Seniors over 55, disabled individuals, and wildfire victims can transfer their tax base to a new property up to three times under Prop 19. This helps people move without losing their low tax rate.

What happens when I transfer property into a trust or LLC?

This depends. Transfers between spouses or revocable living trusts are usually exempt. But some changes—like gifting to a child or moving a property into a business structure—may trigger reassessment. Always check with a tax attorney or consultant before moving title.

How to Estimate Your 2025 California Property Tax

If you’re budgeting for a new development, land acquisition, or personal home, estimating your property tax is a must. The good news? California’s formula is mostly predictable.

Here’s how to get a close estimate—even before you buy.

Use This Quick Rule of Thumb

Multiply your expected purchase price or construction value by 1.25%. This includes:

The base 1% property tax rate

Plus 0.2–0.3% in local fees (schools, bonds, etc.)

Example:

A $900,000 home × 1.25% = $11,250/year in estimated property taxes

This estimate is usually accurate within a few hundred dollars, especially in urban or suburban counties.

Tip for Investors: If you’re building in a new community or overlay zone, local taxes could bump this rate higher—sometimes to 1.5%+. Check with the local assessor or planning offic

📊 Estimate Your 2025 Property Tax

Want More Accuracy? Use These Steps

Find your county’s tax rate (usually listed on the county assessor’s website)

Calculate your assessed value (purchase price or project value)

Add any known special taxes (Mello-Roos, CFDs, parcel fees)

Use your county’s property tax calculator if available

You can also request a projected tax bill during escrow or due diligence—especially for entitled land, subdivisions, or redevelopment sites.

Tips to Reduce or Manage Property Taxes in 2025

Most Californians can’t avoid property taxes—but you can manage them smartly. Here are a few ways to keep your annual bill in check:

1. File for the Homeowners’ Exemption

If you live in the home as your primary residence, you can reduce your assessed value by $7,000. That’s about $70 off your tax bill each year. It’s automatic—but you must file for it after purchase.

2. Be Strategic About Renovations

Big upgrades = higher taxes. Try to phase improvements over time or consult your assessor’s office before pulling permits. Sometimes, repair work won’t trigger reassessment—but structural changes will.

3. Appeal Your Assessed Value

If your county sets your value too high, file an appeal. You’ll need comps or an appraisal showing why your property is worth less. Appeals are free in most counties and can save thousands.

4. Know the Rules for Transfers and Inheritance

Planning to gift property to family or transfer into a trust? The wrong kind of transfer can reset your tax base. JDJ recommends working with a qualified land-use attorney or tax advisor before recording any title changes.

Real-World Case Study: First-Time Buyer vs. Long-Term Owner

Let’s compare two owners of similar homes in different situations.

| Scenario | Purchase Year | Purchase Price | Assessed Value (2025) | Total Annual Tax |

|---|---|---|---|---|

| New Buyer | 2025 | $950,000 | $950,000 | ~$11,875 |

| Long-Term Owner | 2005 | $550,000 | $820,000 (after annual 2% cap) | ~$10,250 |

Even though both homes are now worth nearly $1 million, the new buyer pays more—because their assessed value resets at purchase, while the longtime owner is protected by Prop 13’s 2% cap.

Key Insight for Developers: If you’re holding assets long-term (e.g., build-to-rent models), tax predictability becomes a huge advantage. The longer you hold, the lower your effective rate gets—even as rents rise.

Resources for California Property Taxpayers

Whether you’re researching before a purchase or trying to lower your current bill, the state offers several helpful tools. Below are resources we often recommend to clients during feasibility and due diligence reviews:

Key Links & Agencies

| Resource | Purpose | Link |

|---|---|---|

| California State Board of Equalization | General property tax rules, Prop 13 info, appeal rights | boe.ca.gov |

| County Assessor’s Office | Assessed values, parcel maps, appeal forms | Search “[Your County] Assessor” |

| California Tax Calculator (by SmartAsset) | Quick estimate of your property taxes | smartasset.com |

| Local Planning Departments | Mello-Roos, community facility districts, overlay zones | City or county websites |

| California Legislative Information Portal | Track proposed bills and tax reform laws | leginfo.legislature.ca.gov |

Conclusion: Plan Ahead to Keep Your Property Taxes in Check

So, how much is property tax in California in 2025? The short answer: It depends on where you buy, what you build, and when you bought it. But on average, most property owners pay somewhere between 1.1% and 1.3% of their assessed value.

Understanding how the system works—especially Prop 13 rules, reassessment triggers, and local surcharges—can help you plan smarter and save more. If you’re a developer or investor, taxes should be part of your financial model from day one. And if you’re a homeowner, knowing when and how your bill might change can help you avoid surprises.

California’s property tax laws aren’t going away anytime soon. But with the right advice and a little planning, you can stay ahead of the curve—and protect your property investment long term.

Schedule Your Free Consultation

At JDJ Consulting Group, we help clients make informed real estate decisions—from land acquisition to full development strategy. If you’re buying, building, or entitling property in California, we’ll help you understand how property taxes fit into the bigger picture: cash flow, feasibility, and long-term returns.

Our services include:

Land-use & entitlement consulting

Feasibility & highest-and-best-use studies

Permit expediting and agency coordination

Due diligence for developers, investors, and landowners

📍 Visit us at 12925 Riverside Dr Suite 302, Sherman Oaks, CA 91423

📞 Call (818) 793-5058 or email sales@jdj-consulting.com

💬 Book your Free Consultation today and discover how our real estate and construction consulting services can simplify your next project in Los Angeles.

🆚 Property Tax Comparison: New vs Long-Term Owner

🏡 Buyer in 2025

- • Purchase Price: $950,000

- • Assessed Value: $950,000

- • Rate: 1.25%

- • Annual Tax: $11,875

🧓 Owner Since 2005

- • Original Price: $550,000

- • Assessed Value: $820,000

- • Rate: 1.25%

- • Annual Tax: $10,250

🔍 Over time, Prop 13 protects owners by limiting how fast assessed values—and tax bills—can rise.

FAQs: How Much Is Property Tax in California 2025

What is the current property tax rate in California for 2025?

As of 2025, California’s base property tax rate remains 1% of your property’s assessed value, as set by Proposition 13. However, most property owners pay between 1.1% and 1.3% total after adding in local assessments.

Typical taxes include:

School bonds and parcel taxes

Fire protection and road district fees

Voter-approved levies in specific neighborhoods

For an accurate total, check with your county assessor or use a tool like SmartAsset’s property tax calculator.

How does Proposition 13 protect California property owners?

Proposition 13 limits annual increases to your property’s assessed value. Even if your property’s market value skyrockets, your tax bill will only grow by a maximum of 2% per year—unless there’s a reassessment event.

Key protections include:

Property taxes capped at 1% of assessed value

Annual increases limited to 2%

Reassessment only triggered by a sale, major renovation, or title transfer

This benefits long-term owners by keeping their property taxes stable—even in high-growth areas like Los Angeles or Santa Clara.

Looking to invest in areas with stable tax growth? Check our blog on Los Angeles development for insights.

When does a property get reassessed in California?

A reassessment occurs when your property’s ownership or structure changes significantly. When that happens, the county assessor updates the assessed value to reflect market conditions—raising your annual tax bill.

Reassessment happens when you:

Buy or sell a property

Transfer title to someone (even a child or trust, in some cases)

Add new structures like an ADU or second story

Complete major renovations (new kitchens, garages, etc.)

Learn more about property tax triggers in California from the Board of Equalization.

Can I reduce my property tax bill in California?

Yes, there are a few ways to reduce or manage your annual tax burden in California:

File a Homeowners’ Exemption to save ~$70/year

Appeal your assessed value if it seems too high

Phase your renovations to avoid major reassessments

Explore senior and veteran tax transfer programs under Prop 19

If you’re a builder or investor, JDJ’s land-use consultants can help you time improvements to avoid unnecessary reassessments.

Do ADUs or construction projects increase my property taxes?

Yes. Adding an Accessory Dwelling Unit (ADU), converting a garage, or completing a large remodel will often trigger a partial reassessment of your property’s value.

Here’s what usually happens:

Your original structure’s tax base remains intact under Prop 13

The new square footage is taxed at market value

Future annual increases are capped again at 2%

Building or expanding in LA? Our team offers feasibility studies that include post-construction tax projections.

What are “Mello-Roos” taxes and do I have to pay them?

Mello-Roos taxes are special property taxes used to fund new infrastructure—like roads, schools, and utilities—especially in newer developments or master-planned communities.

You might be responsible for Mello-Roos if:

You’re buying into a new subdivision or urban infill project

The property is located in a Community Facilities District (CFD)

You see a separate line item on your tax bill labeled “Special Assessment” or “CFD”

Always ask your agent or consultant if a parcel is in a Mello-Roos zone before closing. These fees can add thousands annually to your bill.

JDJ Consulting Group advises developers on Mello-Roos disclosures during pre-acquisition due diligence.

Error: Contact form not found.

2 Responses