Affordable housing projects in Los Angeles come with added legal steps. One of the most common—and most misunderstood—is the subordination agreement.

Table of Contents

ToggleMany property owners only hear about it near the end of a project. At that point, delays feel frustrating and expensive. The good news is that the concept itself is not complicated. Once you understand why the Los Angeles Housing Department (LAHD) requires subordination, the process makes much more sense.

This blog explains the basics in plain language. It also shows how subordination fits into housing covenants, title reports, and lender requirements. If you are working on an LAHD-regulated project, this foundation matters.

Subordination Agreement Workflow

- Order a recent Preliminary Title Report

- Identify all existing liens (senior debt, junior debt, home equity loans)

- Request lender to sign a subordination agreement

- If refused, refinance or pay off the existing loan

- Submit updated documentation to LAHD for Housing Covenant approval

- City Attorney reviews and approves

- Record the Housing Covenant in first position

What Is a Subordination Agreement?

A subordination agreement is a legal document that changes the order of liens on a property. In simple terms, it decides who comes first.

Most properties already have a loan recorded against them. That loan is usually secured by a deed of trust or mortgage. When LAHD requires a Housing Covenant to be recorded, it wants that covenant to sit ahead of existing loans in the public record. That is where subordination comes in.

A Simple Explanation of Subordination in Real Estate

Normally, liens follow a basic rule: first recorded, first priority. If a lender recorded its loan before the Housing Covenant, that lender has first position. A subordination agreement flips that order.

With subordination:

The lender agrees to move its lien down.

The Housing Covenant moves up.

The covenant becomes enforceable before the loan in legal priority.

This does not cancel the loan. It only changes ranking. To make this clearer, the table below shows how lien priority changes.

| Scenario | First Priority | Second Priority |

|---|---|---|

| Before subordination | Lender’s deed of trust | LAHD Housing Covenant |

| After subordination | LAHD Housing Covenant | Lender’s deed of trust |

This shift is exactly what LAHD requires before it records the covenant.

Why Lien Priority Matters

Lien priority matters most when something goes wrong. If a property goes into default or foreclosure, the lien in first position controls what survives. Anything behind it may be wiped out. From the City’s point of view, this is critical.

If the Housing Covenant is not first, a lender could foreclose and eliminate the affordability restrictions. That would defeat the purpose of the program. Subordination prevents that risk.

Common Situations Where Subordination Comes Up

Subordination is not unique to affordable housing. It appears often in real estate.

Common examples include:

A property with an existing mortgage entering an LAHD housing program

Refinancing when a home equity line of credit already exists

Construction loans layered over earlier land loans

In LAHD projects, however, subordination is not optional. It is a required condition for approval and recordation.

The LAHD Affordable Housing Covenant

To understand subordination, you also need to understand the document it protects. That document is the Housing Covenant.

What Is an LAHD Housing Covenant?

An LAHD Housing Covenant is a recorded agreement that runs with the land. It places long-term restrictions on how the property can be used.

These restrictions often include:

Affordable rent limits

Income limits for tenants

Reporting and compliance obligations

Long-term affordability periods

Once recorded, the covenant binds current and future owners. It is not tied to one borrower. It stays with the property.

Why LAHD Requires the Covenant

LAHD uses covenants to protect public investment. When a project receives approvals, incentives, or funding tied to affordable housing, the City needs assurance that affordability will remain in place. The covenant is the enforcement tool.

Without it, compliance would be voluntary. That is not acceptable for publicly regulated housing.

Lien Priority Before & After Subordination

| Scenario | First Priority | Second Priority |

|---|---|---|

| Before Subordination | Lender’s Deed of Trust | LAHD Housing Covenant |

| After Subordination | LAHD Housing Covenant | Lender’s Deed of Trust |

Data Source: JDJ Consulting Analysis

How the Covenant Interacts With Loans and Title

Here is where issues often arise.

Most properties already have financing. That financing appears on the Preliminary Title Report (PTR). LAHD reviews this report early and again near the end of the process.

If the PTR shows an active loan:

LAHD checks lien order

The City Attorney reviews priority conflicts

Subordination language is required

The table below summarizes how different documents interact.

| Document | Purpose | Why LAHD Cares |

|---|---|---|

| Deed of Trust | Secures a lender’s loan | Can override the covenant if not subordinated |

| Housing Covenant | Enforces affordability rules | Must remain enforceable after foreclosure |

| Preliminary Title Report | Lists all recorded liens | Shows whether subordination is required |

This is why subordination becomes a late-stage issue for many projects. Even if everything else is complete, the covenant cannot be recorded until lien priority is resolved.

Why This Often Becomes a Last-Minute Problem

Many owners assume lenders will cooperate. Some do. Others move slowly or refuse. From a lender’s view, subordination increases risk. The lender agrees that its loan is no longer first in line. That decision often requires internal approvals.

If this step is delayed, the entire project can stall. That is why early planning matters—and why understanding subordination from the start saves time later.

Why LAHD Requires Subordination Agreements

Once the Housing Covenant is drafted, many owners ask the same question: Why does LAHD insist on subordination at all?

The answer comes down to enforcement, risk, and public accountability. LAHD is not trying to interfere with financing. It is protecting the City’s interest and the long-term affordability of housing.

Below is a clear breakdown of why this requirement exists and how it affects your project.

Ensuring the Housing Covenant Is in First Position

LAHD requires the Housing Covenant to be recorded ahead of all private loans.

This means:

The covenant must appear first on the title record

Any existing deed of trust must move behind it

The lender must formally agree to that change

Without subordination, the covenant would sit in second position. That creates a legal risk. If the property ever goes into foreclosure, a first-position lender could eliminate the covenant entirely. LAHD does not allow that possibility.

Putting the covenant first ensures it survives, no matter what happens with the loan.

Preserving Long-Term Affordability Requirements

Affordable housing programs are designed for the long term. In many cases, affordability restrictions last decades. Subordination supports that goal.

When a lender signs a subordination agreement, it confirms that:

The affordability rules take priority

Rent limits and income restrictions stay in place

Future owners must still comply

This protects tenants and ensures the public benefit does not disappear due to a financial default. From LAHD’s perspective, this is non-negotiable.

Protecting the City’s Legal and Financial Interest

LAHD represents the City of Los Angeles. That role comes with legal responsibility.

If the City allows a covenant to be recorded behind a private loan, it weakens enforcement. In a dispute, the City could lose its ability to enforce compliance.

Subordination removes that risk. It gives the City a clear legal position and avoids conflicts between lenders and public policy goals.

Required Before the Covenant Can Be Recorded

Timing matters here.

LAHD generally requires:

A signed subordination agreement

Proper notarization

Review by the City Attorney

All of this must happen before the Housing Covenant is recorded. Even if the project is otherwise complete, LAHD will not issue final approval until lien priority is resolved. This is why subordination often becomes one of the last steps—and one of the most stressful.

How LAHD Identifies the Need for Subordination

LAHD does not guess. It relies on documentation.

The Preliminary Title Report (PTR) is the key document used to:

Identify all recorded loans

Confirm lien priority

Flag subordination requirements

If the PTR shows an active deed of trust, LAHD will require action.

This applies even if:

The loan is small

The loan is nearly paid off

The loan was disclosed early

The rule is consistent.

Why Lenders Are Sometimes Slow to Cooperate

From a lender’s side, subordination changes risk exposure.

Some lenders:

Require internal legal review

Charge processing fees

Limit subordination for certain loan types

Others may refuse outright. This is not unusual. However, LAHD cannot waive the requirement based on lender preference. That is why owners need backup options, which we will cover next.

Why This Step Causes Project Delays

Delays usually happen for three reasons:

Subordination was not discussed early

The lender took longer than expected

The title report became outdated

Each delay pushes the project closer to expiration deadlines and additional costs. Planning for subordination early reduces these risks.

What If the Lender Is Not Willing to Subordinate?

Not all lenders agree to subordination. When this happens, projects can stall if there is no backup plan.

LAHD understands that lenders have their own policies. However, the City cannot move forward without resolving lien priority. That leaves property owners with two practical options.

Option 1: Refinance With a Lender Willing to Subordinate

Refinancing is often the most common solution. In this case, the existing loan is replaced with a new loan from a lender that agrees to subordinate its lien to the Housing Covenant.

This option works best when:

The property has enough equity

Market interest rates are reasonable

The new lender understands LAHD requirements

Once refinancing is complete, you must submit:

The new loan documents

A subordination agreement from the new lender

An updated Preliminary Title Report

Only then can LAHD revise the covenant language and proceed.

Option 2: Pay Off the Existing Loan

The second option is to pay off the loan entirely.

After payoff:

The lender records a reconveyance

The lien is removed from title

The PTR shows clear ownership

This option removes the need for subordination altogether. However, it is not always financially feasible.

It is most common when:

The loan balance is small

The property owner plans to operate debt-free

The loan is near maturity

How LAHD Reviews Updated Documentation

Once either option is completed, LAHD requires updated records. This includes:

A current title report

Revised covenant language

Confirmation that prior liens are resolved

The planner and City Attorney will review these documents carefully. If anything is missing, the process pauses again.

Why Updated Title Reports Are Critical

Title reports are time-sensitive. Before issuing the Letter of Compliance, LAHD requires a current PTR. Reports older than six months are typically rejected.

This rule protects the City by ensuring:

No new liens were recorded

Ownership has not changed

All lender issues are resolved

Ordering multiple title reports can be costly. That is why early lender confirmation matters.

Common Mistakes to Avoid

Many delays happen due to avoidable errors. Common issues include:

Waiting until final review to contact the lender

Assuming verbal lender approval is enough

Submitting outdated title reports

Underestimating lender review timelines

Each of these can push a project past approval deadlines.

How Early Planning Reduces Risk

The best time to address subordination is at the start. By confirming lender cooperation early, owners can:

Decide whether refinancing is needed

Avoid multiple title report orders

Prevent last-minute legal revisions

Early planning saves time and reduces stress.

Subordination Process Step-by-Step

- Order Preliminary Title Report

- Identify Existing Loans & Liens

- Request Subordination from Lender

- If Refused → Refinance or Pay Off Loan

- Submit Updated Documents to LAHD

- City Attorney Reviews & Approves

- Record Housing Covenant

Why Timing and Updated Title Reports Matter

Even when everyone agrees on subordination, timing can still cause problems. LAHD is strict about documentation dates, especially when it comes to title reports. Many projects slow down not because of disagreement, but because paperwork is no longer current. Understanding this timing helps you avoid repeat costs and approval delays.

The Role of the Preliminary Title Report (PTR)

The Preliminary Title Report is one of the most important documents in the LAHD review process. It shows:

Current ownership

All recorded liens

The order of those liens

LAHD relies on the PTR to confirm whether subordination is required. The City Attorney also uses it to verify that the Housing Covenant will be enforceable once recorded. If the PTR is missing information or is outdated, review stops.

LAHD’s Six-Month Rule

Before issuing the Letter of Compliance, LAHD requires a recent title report. In most cases:

PTRs older than six months are rejected

Even minor changes require a new report

Verbal confirmations are not accepted

This rule applies across the board. It does not matter how far along the project is. The City needs proof that nothing has changed on title.

How Outdated Title Reports Cause Delays

Title reports can become outdated quickly. This often happens when:

A lender records a modification

A refinance is completed

Ownership interests change

A lien payoff is recorded late

If any of these occur, the PTR must be updated. Otherwise, LAHD cannot finalize the covenant. These delays often appear near the end of a project, when deadlines are tight.

The Cost of Ordering Multiple Title Reports

Title reports are not free. Ordering several over the life of a project adds up. Costs increase when:

Subordination is resolved late

Lenders delay recording documents

Final approval is pushed out

Early confirmation of lender cooperation helps avoid repeated orders.

Why Early Title Review Helps Everyone

LAHD requires a title report early in the process, often before invoice approval. Some owners submit older reports at this stage. While this may meet minimum requirements, it creates risk later.

Providing a recent PTR early allows:

Early identification of active loans

Time to contact lenders

Advance planning for refinancing or payoff

This proactive approach reduces surprises near the end.

Best Timing Practices for LAHD Projects

To keep things moving, consider these best practices:

Order a fresh PTR at the start

Confirm lender willingness early

Track document recording dates

Plan for lender review timelines

These steps may seem small. However, they often determine whether a project closes smoothly or stalls.

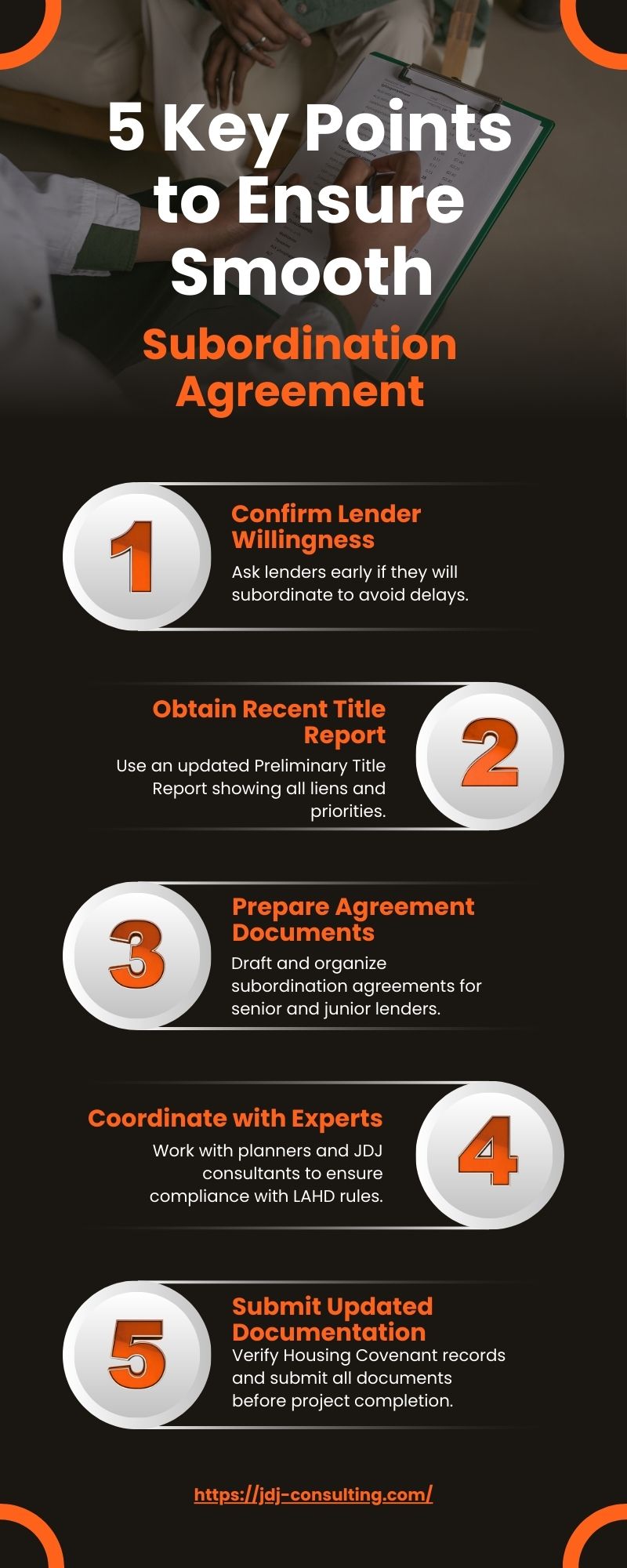

How to Prevent Delays Early in the Process

Most subordination issues are avoidable. Delays usually happen when key steps are pushed too far down the timeline. With early planning, property owners can reduce stress, control costs, and keep LAHD approvals on track.

Confirm Lender Willingness at the Start

The first step is simple. Ask the lender early. As soon as an LAHD covenant is expected, confirm whether the lender will:

Agree to subordinate

Require special conditions

Charge review or processing fees

Do not rely on assumptions. Written confirmation is best. If the lender hesitates, it is better to know right away.

Order a Recent Title Report Early

Even at the early review stage, a current PTR is helpful.

A recent title report allows:

Early identification of liens

Clear visibility of ownership

Advance planning for subordination

While LAHD may accept an older PTR early on, that approach often leads to problems later.

Coordinate With Your Planner and Consultant

Clear communication matters.

Your planner and consultant should know:

Which lenders are involved

Whether subordination is expected

What documents are pending

Sharing this information early helps them flag issues before final review.

Build Subordination Into the Project Timeline

Subordination takes time.

Lenders may need:

Internal legal review

Management approval

Additional documentation

This can take weeks. Planning for it early prevents rushed decisions later.

Avoid Common Early-Stage Mistakes

Many projects fall behind due to small errors.

Watch out for:

Submitting outdated title reports

Waiting for final review to contact lenders

Assuming payoff removes all title issues

Underestimating lender processing times

Avoiding these mistakes saves both time and money.

Why Early Action Saves Money

Every delay has a cost.

Late subordination can lead to:

Multiple title report orders

Extended consultant time

Missed approval windows

Early action keeps the process efficient and predictable.

Setting the Project Up for a Smooth Finish

When subordination is addressed early:

Final review moves faster

Covenant language needs fewer revisions

Approval timelines are easier to manage

This approach benefits everyone involved.

Conclusion

Subordination agreements often feel like a technical detail. In reality, they play a central role in LAHD housing projects.

LAHD requires subordination to protect the Housing Covenant. The covenant must remain enforceable, even if a property faces foreclosure. By placing the covenant in first position, the City ensures long-term affordability and protects public interest.

Problems usually arise when subordination is addressed too late. Active loans appear on the title report, and lenders may be slow or unwilling to cooperate. When this happens near the end of a project, delays become costly.

The solution is early planning.

Confirm lender willingness as soon as the project begins. Order a recent title report early. Review it carefully. If a lender refuses to subordinate, be prepared to refinance or pay off the loan before final review.

Timing also matters. LAHD requires current title reports, especially before issuing the Letter of Compliance. Reports older than six months are often rejected. Staying ahead of this requirement avoids repeated orders and lost time.

In short, subordination is not just a legal formality. It is a key step in keeping LAHD projects moving forward. With early coordination and clear documentation, most delays can be avoided.

If you are planning an LAHD-regulated project and want to reduce risk, addressing subordination early is one of the most effective steps you can take.

Need Help With LAHD Subordination Agreement?

Don’t let lender delays or title report issues slow down your project. JDJ Consulting Group specializes in Affordable Housing and Land Use Compliance. We help property owners and developers resolve subordination agreements, coordinate with lenders, and secure final LAHD approvals efficiently.

Call us: (818) 793-5058

Email: sales@jdj-consulting.com

Contact us: https://jdj-consulting.com/contact-us/

Let JDJ guide your project through LAHD requirements smoothly and avoid costly delays.

Key Tips to Avoid Subordination Delays

- ✅ Confirm lender willingness early

- ✅ Order recent Preliminary Title Report

- ✅ Communicate with your planner and JDJ consultant

- ✅ Plan for refinance or payoff if needed

- ✅ Track document recording dates carefully

FAQs Regarding Subordination Agreement

What is a subordination agreement?

A subordination agreement is a legal document that changes the priority of liens on a property. In real estate financing, it allows an existing loan—like a mortgage or deed of trust—to move behind another obligation, such as an LAHD Housing Covenant.

This ensures the covenant takes first priority while the original lien remains valid. Subordination agreements are commonly used to maintain compliance, protect public policy goals, and allow property owners to secure financing without legal conflicts.

What is an example of a subordination agreement?

An example occurs when a property has a mortgage, and the owner wants to record an LAHD Housing Covenant. The lender signs a subordination agreement, moving its lien behind the covenant. Other examples include:

Subordinating a home equity line of credit behind a senior mortgage

Allowing junior debt to rank below a senior lender

Adjusting lien priority in complex intercreditor agreements

These agreements help property owners comply with regulations while keeping financing intact.

When would a subordination agreement be appropriate?

Subordination agreements are used whenever multiple liens exist and one must take priority. Typical situations include:

Recording an LAHD Housing Covenant

Adding a subordinated loan to an existing senior mortgage

Adjusting promissory notes in development projects

Layering construction financing over existing debt

This ensures lien priority is clear, protecting both lenders and public interest in real estate projects.

Is a subordination agreement a lien?

No. A subordination agreement is not a lien itself. It is a contract that changes the ranking of existing liens, such as a mortgage, home equity loan, or deed of trust. The original liens remain valid but move behind another claim like a Housing Covenant.

This allows lenders to protect their interests while ensuring enforceability of public policy obligations, including affordable housing requirements.

What is the purpose of a subordination agreement?

The purpose is to establish clear lien priority in real estate financing. Specifically, it:

Ensures LAHD Housing Covenants take first priority

Maintains enforceability of affordability restrictions

Allows senior and junior lenders to participate without legal conflicts

Balances financial risk with public policy goals

It protects property owners, lenders, and public agencies in complex financing transactions.

Why is subordination important in real estate or business financing?

Subordination is crucial because lien priority determines which creditors are paid first in case of foreclosure. Without subordination:

Senior lenders could override affordability covenants

Subordinated loans may create conflicts

Projects can face delays and regulatory compliance issues

By using a subordination agreement, property owners, lenders, and public agencies maintain clarity, enforceability, and smooth real estate financing.

What risks or benefits do lenders face when entering a subordination agreement?

Risks:

Losing first lien position, which increases exposure if the property defaults

Reduced ability to recover funds quickly

Benefits:

Allows the project to move forward and comply with LAHD Housing Covenants

Maintains relationships with property owners and regulators

Enables participation in layered financing transactions, including junior debt or subordinated loans

Subordination balances lender risk with long-term project benefits.

Can a lender refuse to sign a subordination agreement?

Yes. Some lenders may refuse because moving their lien behind a Housing Covenant increases financial risk. Property owners then have options:

Refinance with a lender willing to subordinate

Pay off the existing loan and remove the lien from the title

Early planning and clear communication with lenders, planners, and JDJ consultants can prevent delays in recording the covenant.

How does subordination affect senior and junior debt?

A subordination agreement changes the priority of debt. Typically:

Senior debt stays first unless subordinated

Junior debt moves behind the senior or public obligation

All promissory notes and liens are clarified in intercreditor agreements

This ensures that in foreclosure, the Housing Covenant or senior obligations are enforceable, while lenders and property owners understand their rights.

How can property owners prevent delays with subordination agreements?

To prevent delays:

Confirm lender willingness early

Order a recent Preliminary Title Report to identify liens

Coordinate with planners and JDJ consultants

Plan for refinancing, payoff, or subordinated loan adjustments

Proactive steps reduce costs, maintain lien priority clarity, and ensure smooth approval of LAHD Housing Covenants.

What is a subordinated lender?

A subordinated lender is a lender whose loan is ranked behind another obligation in lien priority. For example, in real estate financing with an LAHD Housing Covenant, the subordinated lender agrees to let the covenant take first priority.

While they still have a valid loan, their claim is secondary if the property defaults. Subordinated lenders often participate in projects that require layered financing or multiple loans while accepting slightly higher risk in exchange for project participation.

How does junior debt affect lien priority?

Junior debt is a loan or lien that ranks below senior debt or public obligations like an LAHD Housing Covenant. If a property forecloses, junior lenders are repaid only after senior obligations are satisfied. Subordination agreements clarify

which obligations come first, protecting both lenders and the City’s interest. Properly managing junior debt ensures smooth financing, compliance with housing regulations, and avoids legal conflicts between multiple creditors.

Can a home equity loan be subordinated?

Yes. A home equity loan or home equity line of credit (HELOC) can be subordinated to allow new obligations, such as an LAHD Housing Covenant, to take priority. This requires a subordination agreement signed by the lender, which keeps the original loan valid but moves it behind the covenant.

Subordinating a home equity loan ensures the property owner can secure financing while maintaining compliance with public policy and lender requirements.

What is a security interest and how does it relate to subordination?

A security interest is a lender’s legal claim on collateral, usually a property, to secure repayment of a loan. In subordination agreements, lenders with a security interest may agree to move behind another lien, such as a Housing Covenant.

This allows the covenant to be enforceable while the lender retains a secured claim. Managing security interests properly ensures lien priority clarity and protects both the lender’s financial interest and public compliance requirements.

What role does a deed of trust play in a subordination agreement?

A deed of trust is a legal instrument that secures a loan with real estate. When a property has multiple liens, the deed of trust holder may need to sign a subordination agreement. This moves their lien behind obligations like an LAHD Housing Covenant.

The deed of trust remains valid, but the priority changes. This process ensures that public affordability goals are enforced, and lenders understand their position in real estate financing and lien hierarchy.