Commercial real estate in Los Angeles can be rewarding. But it also comes with many risks. That’s why due diligence is essential. A good consultant helps investors, developers, and lenders make informed decisions. They examine every aspect of a property—from finances to zoning, environmental risks, and structural conditions.

Table of Contents

ToggleIn this guide, we will cover the role of due diligence consultants, what they do, and how to find the best ones in Los Angeles.

Why Due Diligence Consultants Are Essential in Los Angeles

Los Angeles is one of the most complex real estate markets in the country. With high property values, strict zoning laws, and environmental regulations, mistakes can be costly.

Due diligence consultants help reduce these risks. They give investors and developers confidence by providing accurate, detailed insights into a property before making a purchase.

Key benefits of hiring a due diligence consultant in LA:

Identify potential financial or legal issues early.

Ensure zoning and entitlement compliance.

Assess property condition and environmental risks.

Provide accurate market analysis for informed decision-making.

Without proper due diligence, buyers can face delays, fines, or even project failure. Consultants serve as a trusted guide through the process, saving time and money.

What Commercial Real Estate Due Diligence Consultants Do

Due diligence consultants handle many aspects of property evaluation. They combine legal, financial, technical, and market expertise to provide a full picture of the property.

Financial & Investment Analysis

Consultants review the property’s financial history. They examine:

Rent rolls and lease agreements

Operating expenses

Tax records

Cash flow and ROI potential

This analysis helps investors make informed offers and assess profitability.

Sample Financial Due Diligence Table

| Financial Aspect | Purpose | Key Questions to Ask |

|---|---|---|

| Rent Roll | Verify rental income | Are all leases current and valid? |

| Operating Expenses | Check property costs | Are expenses accurate and reasonable? |

| Tax Records | Ensure compliance | Any outstanding property taxes? |

| ROI & Cash Flow Projection | Estimate profitability | Will the property generate the expected return? |

Legal & Zoning Compliance

Legal and zoning issues are critical in Los Angeles. Consultants review:

Property title and ownership history

Liens or encumbrances

Zoning laws and land use restrictions

Entitlement and permit requirements

Sample Legal & Zoning Table

| Legal Aspect | Purpose | Common Issues in LA |

|---|---|---|

| Title & Ownership | Confirm proper ownership | Conflicting deeds, easements |

| Liens & Encumbrances | Identify legal obligations | Unpaid liens, mortgages |

| Zoning Compliance | Ensure permitted use | Variances, restricted uses |

| Permits & Entitlements | Verify approvals for planned projects | Delays from incomplete permits |

By checking these areas, consultants prevent costly legal or zoning surprises. This step is especially important in LA, where rules can vary by neighborhood or district.

Physical & Environmental Assessment

Physical and environmental reviews are next. These checks include:

Roof, HVAC, plumbing, and electrical systems

Phase I and Phase II environmental site assessments

These evaluations help investors understand structural integrity and environmental risks. Issues found early can prevent expensive repairs or regulatory penalties later.

Market & Strategic Analysis

In addition to financial, legal, and physical assessments, a good due diligence consultant evaluates the market and strategic factors. These insights help investors understand the property’s potential and risks in the broader LA market.

Key Areas of Market & Strategic Analysis

Local Market Trends: Assessing supply, demand, rental rates, and absorption trends.

Comparable Properties: Comparing similar properties in the area for valuation and risk assessment.

Neighborhood Factors: Evaluating crime rates, nearby development, and future infrastructure projects.

Strategic Investment Fit: Determining if the property aligns with the investor’s goals, such as long-term hold, redevelopment, or resale.

Market & Strategic Analysis Table

| Factor | Purpose | Example Insights in Los Angeles |

|---|---|---|

| Local Market Trends | Evaluate property demand and pricing | Rising office rents in Downtown LA |

| Comparable Properties | Benchmark property value | Similar retail centers sold recently |

| Neighborhood Factors | Assess risk and growth potential | Planned Metro expansions nearby |

| Strategic Investment Fit | Align property with investor goals | Best for mixed-use redevelopment |

Market and strategic analysis allows investors to make informed decisions that reduce risk and increase profitability.

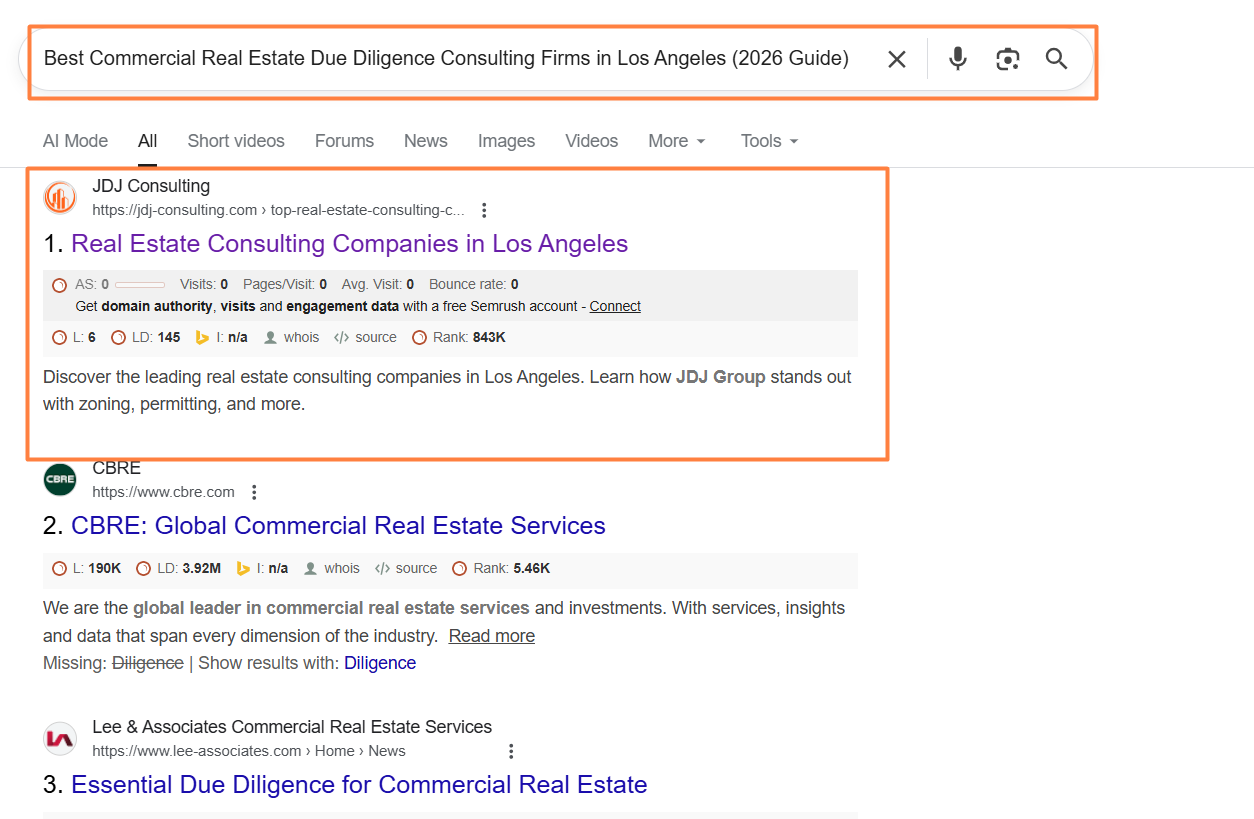

Top Commercial Real Estate Due Diligence Consulting Firms in Los Angeles

Choosing the right due diligence consultant matters in Los Angeles. Not all firms offer the same expertise or services. Below are established firms used by developers, investors, lenders, and owners for detailed commercial property analysis and risk assessment.

1. JDJ Consulting Group

Services Offered:

Due diligence consulting focused on land use and entitlement strategy.

Zoning and eligibility review (including SB 684 compliance).

Coordination of technical studies and requirements.

Application preparation and city agency processing support.

Project coordination and entitlement tracking.

Strengths:

JDJ Consulting Group specializes in Los Angeles land use and entitlement due diligence. The firm reviews zoning, site history, and regulatory constraints to determine what a property allows — before you invest or submit applications. They also coordinate technical reports (like arborist or utility studies) and assemble full application packages to reduce delays. JDJ Consulting

Why Investors & Developers Choose Them:

Local expertise with LA planning codes and subdivision rules.

Hands‑on support through each step of the entitlement approval process.

Regular communication and risk tracking to avoid surprises.

Real Local Experience:

JDJ’s work includes customized due diligence strategies that check zoning, assess site constraints, and layout the steps needed to secure approvals — which helps clients save time and minimize risk before they commit financially.

2. BBG Real Estate Services – Los Angeles Office

Services Offered:

Property and environmental assessments (including Phase I/II).

Appraisal and valuation services.

Property condition reports (structural systems, condition evaluation).

Market studies and feasibility analysis.

Zoning services and construction risk reviews. bbgres.com

Strengths:

BBG is a national commercial real estate services firm with a strong Los Angeles presence. Their local office combines national standards with regional market knowledge. They offer a wide range of due diligence‑related services, from valuation and condition assessment to environmental review.

Why Investors & Lenders Use Them:

Independent and comprehensive reporting trusted by lenders and institutional investors.

Detailed valuation, condition, and risk analysis under one roof.

Deep experience with multifamily, office, retail, and specialty assets.

What Sets BBG Apart:

BBG’s independence and breadth of services make them a preferred choice when clients need unbiased, technical due diligence reports that support financing, acquisition, or disposition decisions.

3. Integra Realty Resources (IRR) – Los Angeles

Services Offered:

Due diligence advisory services.

Transaction support and cash flow modeling.

Comparable data verification and market analysis.

Demographic and economic studies.

Lease review, inspection coordination, and risk assessment. irr.com

Strengths:

Integra Realty Resources (IRR) is well known for its valuation and real estate research capabilities. Their Los Angeles consultants provide deep local market insights combined with structured due diligence for transactions of all sizes.

Why Investors & Developers Hire Them:

Expertise in financial analysis, market trends, and feasibility.

Independent advisory services tailored to individual investor needs.

Strong reputation for accurate valuation and analysis.

What Makes IRR Strong:

IRR’s due diligence goes beyond basic checks; it includes cash flow modeling, market trend analysis, and comparative property review. This helps clients understand the value and risk profile before investing.

Comparison Table – Top CRE Due Diligence Firms in Los Angeles

| Firm Name | Key Services | Notable Strengths | Typical Clients |

|---|---|---|---|

| JDJ Consulting Group | Land use & entitlement due diligence, zoning reviews, technical coordination | Strong LA planning expertise and end‑to‑end entitlement support | Developers, land buyers, investors |

| BBG Real Estate Services | Environmental & property assessments, appraisal, market analysis | Independent reporting, comprehensive assessment services | Lenders, investors, institutional clients |

| Integra Realty Resources | Due diligence analysis, market & financial insights | Deep valuation and research capabilities with local market data | Investors, developers, advisory clients |

Additional Notes

JDJ Consulting Group focuses specifically on Los Angeles land use, entitlement strategy, and due diligence tied to regulatory compliance and application preparation. This makes them a strong choice for investors and developers who need hands‑on coordination with city agencies. JDJ Consulting

BBG Real Estate Services provides wide‑ranging due diligence reports, especially useful when lenders or institutional investors require unbiased, technical evaluations before closing. bbgres.com

Integra Realty Resources (IRR) excels in market analysis and valuation‑oriented due diligence, making them ideal for clients focusing on investment decisions backed by strong data and financial insights. irr.com

Checklist: Choosing the Right CRE Due Diligence Firm in Los Angeles

This checklist ranks firms based on project type, services offered, and strengths. It helps you select a consultant that best fits your specific needs.

1st Step: Identify Your Project Type

| Project Type | Recommended Focus Area in Due Diligence |

|---|---|

| Multifamily/Residential | Financial review, market analysis, zoning compliance |

| Office/Commercial | Property condition assessment, environmental review |

| Retail/Shopping Centers | Market study, tenant analysis, environmental & zoning checks |

| Industrial/Warehousing | Site logistics, environmental hazards, entitlement review |

| Mixed-Use Development | Full-spectrum due diligence including entitlement strategy |

2nd Step: Match Services to Your Needs

| Service Type | Key Firms for LA | Why It Matters |

|---|---|---|

| Zoning & Entitlement Strategy | JDJ Consulting Group | Ensures your project meets LA planning regulations |

| Environmental & Technical Assessment | BBG Real Estate Services, ESE Partners | Identifies contamination or structural risks |

| Valuation & Market Analysis | Integra Realty Resources | Supports investment decisions with data |

| Financial Modeling & Cash Flow Review | Integra Realty Resources, BBG Real Estate | Ensures ROI and risk are properly evaluated |

| Technical Coordination & Applications | JDJ Consulting Group | Saves time and avoids city approval delays |

3rd Step: Evaluate Firm Strengths

| Factor | What to Look For | Recommended Firm(s) |

|---|---|---|

| Local Market Knowledge | Deep understanding of LA zoning and regulations | JDJ Consulting Group, BBG Real Estate |

| Independent Reporting | Unbiased, reliable assessments for investors/lenders | BBG Real Estate Services |

| Comprehensive Services | One-stop solutions covering financial, legal, technical | JDJ Consulting Group |

| Valuation Expertise | Accurate property valuation and market insight | Integra Realty Resources |

| Track Record with Similar Projects | Proven success in similar property types | All three top firms depending on scope |

4th Step: Rank Firms for Your Project

JDJ Consulting Group – Best for land use, entitlement-heavy projects, and development coordination in LA. Ideal for developers and investors handling complex approvals.

BBG Real Estate Services – Best for institutional or multi-property investments requiring independent environmental, technical, and condition assessments.

Integra Realty Resources (IRR) – Best for investment-focused clients needing market research, valuation, and financial analysis.

5th Step: Ask These Key Questions Before Hiring

How much experience do you have with this property type in Los Angeles?

Do you provide integrated due diligence (financial, technical, legal, market)?

Can you coordinate city approvals and entitlements if needed?

What is the estimated timeline and deliverables?

How do you handle risk reporting and recommendations?

Environmental & Technical Specialists

Some aspects of due diligence require specialized knowledge. Environmental and technical consultants focus on areas that can significantly impact a property’s value and usability.

Key Environmental & Technical Services

Phase I Environmental Site Assessments (ESA): Identify potential contamination or regulatory concerns.

Phase II ESA (if needed): Detailed testing to confirm the presence of contaminants.

Property Condition Assessments (PCA): Inspect building systems, structure, and major components.

Engineering and Infrastructure Review: Assess structural integrity, utilities, and site improvements.

Why This Matters in Los Angeles:

LA has strict environmental and building codes.

Older buildings may have asbestos, lead, or seismic risks.

Proper assessment prevents costly surprises after purchase.

Top Environmental & Technical Firms in LA

| Firm Name | Focus Area | Key Strengths |

|---|---|---|

| Geo Forward | Phase I/II ESA, environmental risk | Local experience, regulatory expertise |

| ESE Partners | Environmental & engineering | Integrated environmental and technical support |

| AEI Consultants | PCA, building systems, site review | Strong track record on commercial projects |

How to Choose the Right CRE Due Diligence Consultant in LA

Selecting the right consultant is critical. Not all firms offer the same services or depth of expertise. Here’s how to make the right choice.

1. Assess Firm Expertise

Look for experience in Los Angeles commercial real estate.

Ensure familiarity with zoning laws, entitlements, and local market trends.

Check past project examples and client references.

2. Evaluate Services Offered

Determine if the firm provides integrated services (financial, legal, environmental, technical).

Some firms focus only on niche areas—make sure it aligns with your needs.

3. Compare Costs vs. Value

Fees may vary based on scope and property size.

Consider the potential savings from avoiding legal, zoning, or environmental issues.

4. Look for Red Flags

Limited LA-specific knowledge.

Lack of detailed reporting or coordination across disciplines.

Poor communication or unclear deliverables.

Checklist for Choosing a Consultant

| Criteria | Why It Matters |

|---|---|

| Local Expertise | Reduces risk of compliance or zoning issues |

| Range of Services | Ensures all aspects of due diligence are covered |

| Track Record | Provides confidence in results |

| Clear Communication | Smooth process and timely reporting |

| Cost vs. Value | Balances budget with risk mitigation |

Benefits of Hiring a Professional Due Diligence Consultant

Hiring a skilled consultant offers tangible advantages for any CRE project in Los Angeles.

Reduces Investment Risk: Identify issues before they become costly problems.

Speeds Up Approvals and Entitlements: Experienced consultants know the processes and requirements.

Strengthens Negotiation Power: Detailed reports allow buyers to negotiate better terms.

Prevents Costly Surprises: Structural, environmental, or legal problems are addressed early.

Improves Decision Confidence: Investors and developers can make informed choices backed by data.

Even a single oversight can delay projects or reduce ROI. A professional consultant ensures every aspect is evaluated and documented, providing peace of mind and smoother transactions.

Case Studies – Successful Due Diligence in Los Angeles

Real-life examples show how professional due diligence consultants save time, money, and prevent costly mistakes.

Example 1: Avoiding Zoning Violations

A developer planned a mixed-use project in Downtown LA. Early engagement of a due diligence consultant revealed zoning restrictions that could have halted the project mid-construction.

Outcome:

Project plans were adjusted before submission.

Six months of potential delays were avoided.

Costs were minimized, and approvals were secured smoothly.

Example 2: Discovering Environmental Issues

An investor considered an older industrial property in East LA. Environmental specialists identified soil contamination risks. The early assessment allowed the buyer to negotiate remediation costs with the seller.

Outcome:

Investor saved tens of thousands in cleanup costs.

The property purchase remained profitable.

Regulatory compliance was ensured, avoiding fines.

Lessons Learned Table

| Challenge | Consultant Role | Result |

|---|---|---|

| Zoning compliance | Reviewed zoning and entitlements | Avoided project delays and fines |

| Environmental contamination | Phase I/II ESA, soil testing | Negotiated remediation, ensured compliance |

| Property condition concerns | PCA, structural review | Prevented unexpected repair costs |

These case studies highlight how comprehensive due diligence mitigates risk and ensures smoother transactions in Los Angeles.

Conclusion – Choosing the Best CRE Due Diligence Consultant in Los Angeles

Choosing the right consultant is critical for success in LA’s complex commercial real estate market.

Experienced consultants reduce risk, prevent costly mistakes, and save time.

Integrated services covering financial, legal, technical, and market assessments ensure a thorough evaluation.

Case studies show tangible benefits, from avoiding zoning violations to identifying environmental issues early.

Investors and developers can make confident, data-driven decisions when they work with the right professionals.

Resources & Next Steps

Downloadable Due Diligence Checklist: Essential for evaluating potential properties.

JDJ Consulting Services: https://jdj-consulting.com – Full suite of LA-specific due diligence, entitlement, and zoning consulting.

Additional Reading: Local zoning guides, market reports, and commercial real estate trends.

FAQs: Best Commercial Real Estate Due Diligence Consulting Firms Los Angeles

What is commercial real estate due diligence?

Commercial real estate due diligence is the process of thoroughly evaluating a property before purchase or investment. It includes:

Reviewing financial statements and rent rolls

Checking zoning and land use compliance

Conducting physical and environmental inspections

Assessing market trends and investment risks

The goal is to identify potential risks and ensure the property meets investment objectives.

Why is due diligence important in Los Angeles?

Los Angeles has complex zoning laws, high property values, and strict environmental regulations. Proper due diligence:

Reduces financial and legal risks

Ensures zoning and entitlement compliance

Helps identify hidden property or environmental issues

Supports informed investment decisions and project planning

What services do CRE due diligence consultants offer?

Consultants provide:

Financial and market analysis

Legal and zoning reviews

Property condition assessments (PCA)

Environmental site assessments (Phase I/II)

Entitlement and permitting guidance

These services ensure investors have a comprehensive view of a property before making a purchase.

How do I choose the right CRE due diligence consultant in LA?

Consider the following:

Local expertise in LA zoning and land use

Range of services offered (financial, technical, legal)

Track record with similar projects

Communication and reporting style

Cost vs. value for the services provided

Matching a consultant to your property type ensures thorough evaluation.

How long does the due diligence process take?

The process typically takes 30–60 days but depends on property size and complexity. Steps include:

Gathering financial and legal documents

Conducting inspections and assessments

Analyzing results and compiling reports

For large or complex developments, timelines may extend up to 90 days.

What is included in a due diligence report?

A comprehensive report includes:

Financial analysis and projections

Property condition assessments

Zoning and entitlement compliance review

Environmental risk analysis

Market and investment feasibility study

This report provides actionable insights for informed investment decisions.

Do I need a consultant for every commercial property purchase?

While not mandatory, consultants are highly recommended for:

Multi-million-dollar transactions

Properties with complex zoning or entitlements

Older buildings with potential environmental hazards

Projects requiring financing from lenders who demand third-party due diligence

How much does CRE due diligence consulting cost in LA?

Costs vary depending on property size, complexity, and services needed:

Small properties: $5,000–$10,000

Mid-size properties: $10,000–$25,000

Large or complex projects: $25,000–$50,000+

Comprehensive, integrated services typically offer higher value by preventing costly mistakes.

What is a Phase I Environmental Site Assessment (ESA)?

Phase I ESA identifies potential environmental contamination risks, including:

Soil and groundwater contamination

Hazardous materials like asbestos or lead

Regulatory compliance issues

If risks are identified, a Phase II ESA may follow for detailed testing.

What is a Property Condition Assessment (PCA)?

A PCA evaluates the physical condition of a property, including:

Roof, HVAC, plumbing, and electrical systems

Structural integrity of buildings

Life safety and code compliance

It helps investors estimate repair or maintenance costs and future liabilities.

How do zoning laws affect commercial property due diligence?

Zoning laws determine allowable property uses and building requirements. Due diligence ensures:

Planned development complies with local zoning

Variances or permits are identified early

Potential restrictions or conflicts are mitigated

Non-compliance can delay projects or incur fines.

Can consultants help with LA entitlement and permitting?

Yes, many consultants specialize in:

Navigating LA City Planning approvals

Preparing and submitting permit applications

Coordinating with local agencies

Tracking approval timelines

This support accelerates project approvals and reduces risk of rejection.

What financial documents are reviewed during due diligence?

Key documents include:

Rent rolls and lease agreements

Operating expenses and maintenance costs

Property tax records

Income statements and historical cash flow

These help assess investment viability and projected ROI.

What risks can due diligence uncover?

Due diligence can reveal:

Environmental hazards (contamination, asbestos)

Zoning violations or development restrictions

Structural or building system defects

Financial misstatements or uncollectible rents

Early detection allows negotiation or mitigation before purchase.

What types of properties require the most detailed due diligence?

High-risk properties include:

Older buildings with deferred maintenance

Properties in redevelopment zones

Industrial sites with potential contamination

Mixed-use or multi-tenant complexes

Complexity and age increase the need for thorough evaluation.

How do market trends impact CRE due diligence?

Market analysis informs investment decisions by assessing:

Rental demand and vacancy rates

Comparable property pricing

Neighborhood growth potential

Economic and demographic trends

It ensures projected returns are realistic.

Can due diligence reduce investment risk?

Yes. By evaluating financial, legal, technical, and environmental factors, investors can:

Avoid unexpected costs or fines

Negotiate better purchase terms

Ensure compliance with local regulations

Make confident, data-backed investment decisions

Are CRE due diligence consultants different from brokers?

Yes. Consultants provide independent analysis and risk assessment, whereas brokers focus on:

Selling or leasing properties

Transaction negotiation

Market representation

Consultants act as advisors, ensuring the property is suitable before purchase.

How often should due diligence be updated?

Due diligence should be performed before each purchase. For long-term or ongoing projects:

Financials should be reviewed annually

Physical and environmental assessments may be updated every 3–5 years

Regular updates ensure continued compliance and risk awareness.

How do consultants coordinate multiple assessments?

Consultants often manage:

Environmental site assessments

Property inspections and technical studies

Financial and legal reviews

They consolidate findings into a single comprehensive report for investors, reducing confusion and delays.

What should I ask a due diligence consultant before hiring?

Key questions include:

Experience with LA zoning and entitlements

Types of properties handled

Scope of services offered

Reporting and deliverable formats

Timeline and estimated costs