Insights Into Los Angeles Housing Market Update 2025

If you’re planning a move to Los Angeles or Orange County in 2025, understanding today’s housing market is more important than ever. These two counties make up one of the largest and most expensive real estate regions in the country, and the market here rarely behaves like the national average.

Table of Contents

ToggleThe past few years have been full of change. Interest rates rose in 2022 and 2023, slowing buyer demand. Then, in 2024, many homeowners decided to stay put, creating limited supply. Now, in 2025, we’re seeing a mix of challenges and opportunities. Prices are still high, but inventory looks different depending on the type of property.

For buyers, that means strategy matters. Choosing between a single-family home or a condo can affect how much leverage you have and how far your budget stretches. For sellers, it means knowing whether the market is leaning in your favor—or if you need to adjust your expectations to attract offers.

It’s also important to remember that Los Angeles and Orange County are huge regions with many distinct neighborhoods. Market statistics at the county level provide a broad overview, but what’s happening in Malibu or Irvine may not match the trend in Highland Park or Anaheim. That’s why this update is best seen as a big-picture guide, with local research still being key for anyone making a move.

With that context in mind, let’s dive into the first category: single-family homes.

Single-Family Homes Trends (January 2025)

Single-family homes remain the most desired type of housing in Southern California. They offer privacy, outdoor space, and long-term value—qualities that are highly prized in Los Angeles and Orange County. But the numbers show that competition for these properties hasn’t gone away, even as the overall market has cooled from the frenzy of a few years ago.

Here’s how single-family homes are performing in early 2025.

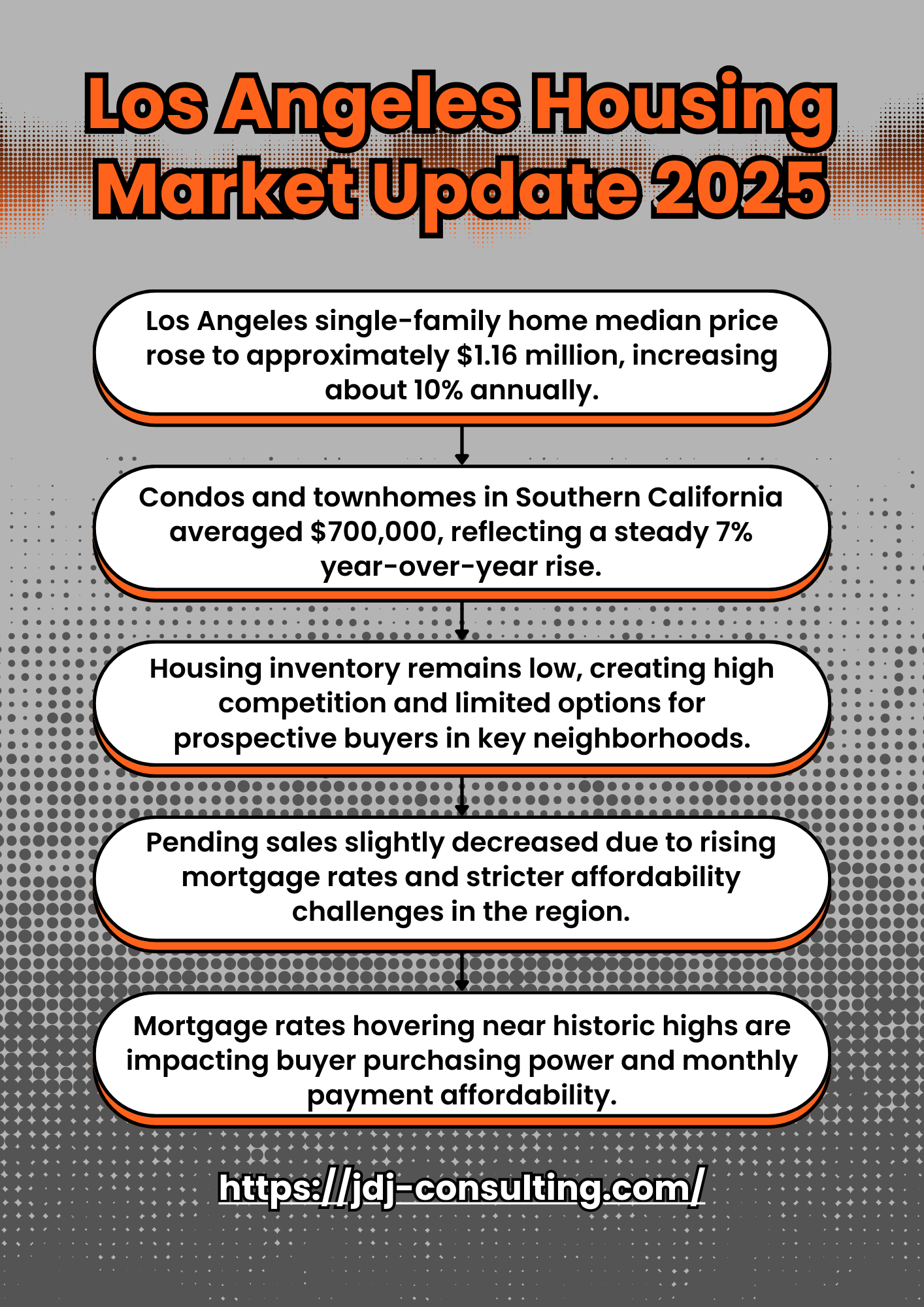

Median Sales Price: $1,155,000 — Up 10% from Last Year

The median sales price for single-family homes across LA and Orange County hit about $1.16 million in January 2025, a 10% increase compared to last year. That’s a big jump, especially given how affordability is already stretched.

Why are prices still climbing? It comes down to supply and demand. Many homeowners are still reluctant to sell because they locked in low mortgage rates years ago. This limits the number of homes for sale, creating competition for the ones that do hit the market. With limited choices, buyers who need to move—whether for jobs, schools, or family reasons—are paying a premium.

For buyers, this means budgeting carefully and being prepared to act quickly on a property you like. For sellers, rising prices are an advantage, but it doesn’t mean homes sell instantly. Buyers today are more cautious and willing to negotiate.

Median Sales Price

Source: JDJ Consulting Group, 2025 Market Data

Pending Sales: Down 35%

While prices are up, pending sales—the number of homes going under contract—have fallen sharply. They’re down about 35% compared to last year.

This decline shows that fewer buyers are actively making offers. High interest rates, even though they’ve inched slightly lower than in 2023, are still keeping some would-be buyers on the sidelines. Others are waiting for more inventory or hoping for price adjustments later in the year.

For sellers, this slowdown in pending sales is a reality check. Even though values are higher, you may need to be flexible on terms or pricing to actually secure a buyer.

Inventory: Down 3%

Inventory for single-family homes is still tight, down about 3% year over year. While this is a smaller drop than in past years, it highlights an ongoing challenge in Southern California: there simply aren’t enough single-family homes to meet demand.

The reasons are structural. Strict zoning laws, limited buildable land, and wildfire-prone areas reduce the ability to add more housing. At the same time, homeowners with older mortgages are holding onto their properties. The end result is that even in 2025, supply hasn’t caught up to need.

Year-over-Year % Change

Source: JDJ Consulting Group, 2025 Market Data

Days on Market: Up Nearly 18%

Homes are taking longer to sell. The average days on market climbed nearly 18%, meaning buyers have a little more breathing room than during the peak pandemic years when homes sold in a week.

For buyers, this is good news. More time means more opportunity to do inspections, compare properties, and negotiate. For sellers, it means patience is required. Overpricing a home can cause it to sit for weeks, which may hurt its appeal.

New Listings: Down About 12%

New listings dropped by roughly 12% in January 2025. This is connected to the lock-in effect. Many homeowners don’t want to trade their 3% mortgage rate for today’s 6% rates, so they’re choosing not to sell.

This trend keeps the market tight, even as buyer demand slows. With fewer new properties entering the market, competition stays focused on a smaller pool of homes.

Townhouses & Condos Trends (January 2025)

Townhouses and condos tell a different story from single-family homes. They are often more affordable, attract first-time buyers, and appeal to downsizers who want less maintenance. In Los Angeles and Orange County, they also provide a way to live closer to job centers without the same cost as a detached house.

The January 2025 numbers show a market that is softer than single-family homes, with more options available and longer selling times.

Median Sales Price: $700,000 — Up 7%

The median price for condos and townhouses climbed 7% in the past year, reaching about $700,000. This increase is smaller than the single-family jump, but it still shows steady upward pressure.

Even at $700,000, these properties remain significantly more affordable than single-family homes. For many buyers, especially younger professionals or small families, condos and townhomes are the entry point into the Southern California housing market.

Pending Sales: Down Nearly 40%

Pending sales for condos and townhouses dropped almost 40% compared to last year. This suggests that buyer activity in this segment has slowed even more than for single-family homes.

Why? While condos are cheaper, they often come with HOA fees, which can add hundreds of dollars to monthly costs. Combined with higher mortgage rates, the total monthly payment can still feel out of reach for many.

Inventory: Up 32%

Unlike single-family homes, condo and townhouse inventory actually increased. Listings are up more than 30% compared to last year. This gives buyers more options and reduces competition.

For buyers, this is an opportunity. With more choices and fewer competing offers, you may have room to negotiate on price, closing costs, or repairs. Sellers in this segment may need to price more competitively or be willing to make concessions.

Inventory Change

Source: JDJ Consulting Group, 2025 Market Data

Days on Market: Up 29%

Condos and townhouses are taking nearly a third longer to sell compared to last year. This reflects softer demand and higher supply.

Buyers gain leverage in this situation. Instead of rushing, you can shop around, compare different buildings, and even submit lower offers knowing sellers may not have multiple buyers waiting.

New Listings: Up 4%

New condo and townhouse listings rose slightly in January 2025, adding to the growing supply. Some of this is due to new construction projects delivering units to the market, especially in areas like Downtown Los Angeles, Koreatown, and parts of Irvine.

For buyers, this means more variety and potentially more modern options. For sellers, it adds competition, making it important to highlight unique features and amenities to attract interest.

Disclaimer on Data Accuracy

When looking at real estate data, it’s important to understand what these numbers really represent. The January 2025 update covers all of Los Angeles County and Orange County combined. Together, that’s more than 13 million people and thousands of neighborhoods, from Beverly Hills to Long Beach to Anaheim.

Because of this, the numbers give us a “big picture,” but they don’t always reflect what’s happening in one specific community. For example:

The median single-family price might be $1.15 million across both counties, but in Santa Monica, the median can be closer to $2.5 million.

A condo in Irvine might sell for around $900,000, while a condo in parts of the San Fernando Valley could be $500,000.

Inventory could be rising in one city while shrinking in another.

That’s why these numbers are helpful for spotting general trends, like whether buyers have more negotiating power or whether prices are rising overall. But for real decision-making—like choosing where to buy or setting the right asking price as a seller—you need local, neighborhood-level data.

This is especially true in Southern California because the market is so hyper-local. A few blocks can make a major difference in pricing, demand, and even lending requirements if the property is in a fire zone, flood zone, or hillside overlay.

The bottom line: think of countywide statistics as a weather forecast. They tell you if it’s sunny or rainy across the region, but they don’t always tell you if one neighborhood will be windy while another is calm.

Market Sentiment

Source: JDJ Consulting Group, 2025 Market Data

What This Means for Buyers

If you’re considering buying in Los Angeles or Orange County in 2025, here’s what the current market means for you.

Single-Family Homes: Still Competitive

Single-family homes remain in short supply. Prices rose 10% over the past year, and inventory is still down. That means if you want a detached home, be prepared for competition.

Expect to pay a premium for desirable areas, especially those near good schools or with larger lots.

Be ready to move quickly when you find a property you like. Homes may stay on the market longer than in 2022, but attractive listings still draw multiple offers.

Have your financing in place before making an offer. Pre-approval signals to sellers that you’re serious and capable of closing.

Townhouses & Condos: More Room to Negotiate

The condo and townhouse market looks very different. With inventory up by 32% and pending sales down nearly 40%, buyers have more leverage here.

You can take your time. Units are sitting longer, so you don’t need to rush decisions.

Consider negotiating. Sellers may be open to price reductions, closing cost credits, or repair concessions.

Weigh total costs. While purchase prices are lower than single-family homes, remember to factor in HOA fees and special assessments.

Overall Strategy for 2025 Buyers

Be flexible. If single-family prices are out of reach, look at townhomes or condos in neighborhoods you like.

Think long-term. Even if prices feel high, Southern California real estate historically holds value because of limited land and strong demand.

Prioritize location. Buying in an area with good amenities, schools, or job access can protect your investment even in market shifts.

The key for buyers in 2025 is balancing patience with preparation. The market is not as frenzied as it was during the pandemic, but competition remains for the most desirable properties.

Broader Market Context

Understanding the housing market in Los Angeles and Orange County means looking beyond just monthly numbers. Several broader forces are shaping 2025 trends:

Inventory Remains Below a Balanced Market

Economists often talk about a “balanced market” as one where there are 5–6 months of supply. In LA and OC, supply is still below that level, especially for single-family homes. This keeps upward pressure on prices, even when demand slows.

Interest Rates Are Easing but Still Elevated

Mortgage rates climbed in 2022–2023 and only started easing slightly in late 2024. As of January 2025, rates remain higher than many buyers would like—around 6% for a 30-year fixed loan. That’s better than the peaks of 2023 but still much higher than the 3% rates homeowners enjoyed in 2020–2021.

This is one reason many people are reluctant to sell: moving means trading a low mortgage for a higher one. It also limits how much new buyers can afford.

Economic and Job Market Stability

Southern California remains a strong economic hub. Entertainment, tech, logistics, healthcare, and education are all major industries here. Job stability supports housing demand, especially from high-income professionals who can afford the region’s prices.

Climate and Fire Zone Considerations

Wildfires remain a concern in hillside and canyon areas. In 2025, insurance costs in high-risk zones are higher, and some insurers have limited coverage in certain parts of LA County. This has a direct impact on affordability and may push some buyers toward lower-risk areas.

Long-Term Investment Value

Despite the challenges, real estate in Los Angeles and Orange County has historically proven to be a strong investment. Limited land, strict zoning rules, and constant demand from both local and global buyers mean property values generally trend upward over time.

For investors, this broader context reinforces why LA and OC continue to attract interest. For homebuyers, it explains why affordability remains tough but also why owning here often pays off in the long run.

The Importance of Local Data

One of the biggest truths about the Los Angeles and Orange County housing markets is that they are hyper-local. Countywide statistics—like a $1.15 million median home price—are helpful for seeing broad shifts, but they don’t tell the full story.

In fact, two neighborhoods just a few miles apart can show completely different patterns:

Santa Monica vs. West Adams – Santa Monica’s median single-family price sits above $2.5 million, while parts of West Adams may average around $1 million.

Irvine vs. Garden Grove – A new-build townhouse in Irvine might sell for close to $1 million, while a similar-size condo in Garden Grove could cost $600,000.

Silver Lake vs. San Fernando Valley – Days on market might be under two weeks in trendy Silver Lake, while homes in parts of the Valley can take months to sell.

Days on Market

Source: JDJ Consulting Group, 2025 Market Data

How are home prices trending in Los Angeles this year?

Home prices in Los Angeles remain high, though growth has slowed. The median home price shows small month-to-month shifts, while buyers watch interest rates closely. Rising mortgage rates continue to affect affordability and monthly payments.

2. What factors are driving housing market dynamics in Southern California?

The housing market in Southern California is shaped by several elements:

Mortgage rates and overall interest rate policy from the Federal Reserve

Housing supply and the unsold inventory index

Consumer confidence and broader economic signals such as the stock market

Regional differences across Los Angeles County, Orange County, and the Inland Empire

3. How does Los Angeles compare to other California housing markets?

The Los Angeles housing market has unique pressures compared with the Bay Area or San Diego. While the Bay Area shows sharper price cuts, Los Angeles has steadier home values. San Diego County and Orange County see similar affordability challenges but smaller active listings pools.

4. What is happening with home sales volume in Los Angeles County?

Home sales volume has dropped compared to last year. Higher interest rates and affordability index pressures have slowed activity. Many single-family home sellers face longer market times, while buyers hesitate due to rising monthly costs.

5. How are mortgage rates shaping the Los Angeles housing market?

Mortgage rates have a direct effect on affordability and monthly payments. When rates rise, fewer buyers qualify for loans. This lock-in effect discourages homeowners from selling because their current loan is cheaper than new borrowing costs.

6. What role does housing supply play in today’s real estate trends?

Housing supply remains tight in the Los Angeles Metro Area. Limited construction starts and slow permitting keep active listings low. The unsold inventory index shows a shortage of homes compared with demand, keeping market dynamics competitive.

7. How do median price changes reflect buyer demand?

The median price and median sales price are strong indicators of buyer activity. When prices rise faster than median household income, affordability weakens. Price reductions are becoming more common in some ZIP codes, signaling softer demand in certain neighborhoods.

8. Are bidding wars still common in Los Angeles real estate?

Bidding wars have cooled compared with the peak years. However, they still appear in coastal areas and neighborhoods with limited housing supply. Properties near strong school districts or close to public transit can still attract multiple offers above purchase price.

9. How do monthly costs affect first-time buyers in Los Angeles?

Monthly costs extend beyond the purchase price. Buyers must factor in:

Mortgage payments driven by current interest rates

HOA fees for condos and townhomes

Property taxes based on home values

Rising housing costs in utilities and insurance

These costs lower the housing affordability index for many entry-level buyers.

10. What is the outlook for the Los Angeles housing market in 2025?

Market data suggests a cautious year ahead. Home values may grow slightly, but affordability pressures remain. The California housing market forecast points to slow improvement if interest rates stabilize. Buyers should buy smart, and sellers need to sell strategically in this environment.

This variation makes local knowledge essential. If you’re moving to Los Angeles or Orange County in 2025, don’t rely only on the countywide data. Instead, ask questions like:

How many homes are selling in this specific zip code?

Are prices rising faster here than in the county overall?

What are average HOA fees in this condo community?

Are there wildfire, hillside, or coastal overlay restrictions that affect insurance or building rights?

For buyers, this kind of detail can mean the difference between overpaying and spotting a smart deal. For sellers, it can help you price competitively and avoid sitting on the market too long.

At JDJ Consulting Group, we often remind clients: real estate in LA is block by block. Hyper-local data, combined with expert guidance, is the only way to make confident decisions in a market this complex.

Conclusion

The January 2025 housing market update for Los Angeles and Orange County shows a market defined by contrasts.

Single-family homes remain highly competitive. Prices are up 10% year over year, but inventory is still tight, keeping pressure on buyers who want privacy and land.

Condos and townhomes tell a different story, with inventory up 32% and pending sales down nearly 40%. Buyers here have more choices, more leverage, and more time to negotiate.

Countywide data is useful but limited. Every neighborhood has its own trends, influenced by location, schools, amenities, and even climate risks.

For buyers, this means coming prepared—knowing your budget, understanding interest rates, and being flexible about property types. For sellers, it means pricing wisely and recognizing that not every segment of the market is moving at the same pace.

Most importantly, the broader outlook for Los Angeles and Orange County real estate remains strong. Supply is still below balanced levels, zoning restrictions keep new development limited, and long-term demand for Southern California living is unlikely to fade. That combination supports values over time, even if the short-term market feels uneven.

If you’re considering a move, investment, or sale in 2025, the smartest step is to focus on local insights. Broad statistics provide context, but neighborhood-level expertise and tailored strategies will help you make the right call.

In a region as large and dynamic as Southern California, success in real estate comes from more than watching the numbers—it comes from understanding the story behind them.

Ready to take the next step? Contact JDJ Consulting today at (818) 793-5058, email us at sales@jdj-consulting.com, or book your free consultation. Learn more about our services here.

FAQs – Los Angeles Housing Market 2025

1. What is the median home price in Los Angeles in 2025?

The median sales price for a single-family home in Los Angeles is about $1,155,000, reflecting a 10% increase year-over-year. Townhomes and condos are more affordable at around $700,000, up 7% from last year.

Single-family: $1.155M (up 10%)

Condos/Townhomes: $700K (up 7%)

2. Why are pending home sales dropping in Los Angeles?

Pending sales are down 35–39%, mostly due to high interest rates, affordability challenges, and limited inventory. Buyers are cautious, making fewer homes go under contract.

Higher borrowing costs slowing demand

Buyers waiting for price adjustments

Limited attractive listings

3. Is Los Angeles still a seller’s market in 2025?

Yes, but only for single-family homes. Limited supply is keeping prices competitive. For condos and townhomes, however, inventory has grown, making it more of a buyer’s market.

Single-family: Seller’s market (low supply, fast competition)

Condos/Townhomes: Leaning toward buyer’s market

4. How long does it take to sell a home in Los Angeles in 2025?

On average, homes are taking 18–29% longer to sell compared to last year. Many homes now sit 30–45 days on the market, especially condos.

Single-family: ~30 days average

Condos/Townhomes: ~45 days average

5. Is housing inventory improving in Los Angeles?

Only slightly. Single-family homes are down 2.7%, keeping the market tight. Condos, on the other hand, are up 31.8%, giving buyers more options.

Single-family inventory: Lower than last year

Condo inventory: Significantly higher

6. Why are fewer homes being listed in Los Angeles?

New listings are down 11.6%, as many homeowners choose not to sell due to high mortgage rates and uncertainty about affordability when buying again.

Lock-in effect (owners keep low-rate mortgages)

Rising replacement home costs

Market hesitation

7. What does the Los Angeles condo market look like in 2025?

Condos and townhomes have more inventory and are taking longer to sell. This creates negotiation power for buyers, especially with sellers more flexible on pricing.

Median price: $700K

Inventory: Up 31.8%

More leverage for buyers

8. Should I buy a single-family home or condo in Los Angeles right now?

It depends on your goals. Single-family homes are more competitive but hold long-term value. Condos and townhomes offer more buyer flexibility in 2025.

Buy single-family for long-term growth

Buy condo/townhome for affordability & negotiation room

9. How do wildfires affect the Los Angeles housing market?

Wildfires push demand into unaffected areas, raising prices there. Insurance costs are also rising in high-risk zones, making some neighborhoods less attractive.

Increased demand in safe zones

Higher insurance premiums

Rebuilding opportunities in affected areas

10. Is Los Angeles housing affordable in 2025?

Affordability remains a major challenge. With median prices above $1M, most buyers need dual incomes or high down payments. Condos are slightly more affordable but still costly.

Median income doesn’t match home prices

Affordability gap widening

Condos provide some relief

11. What’s the biggest challenge for LA homebuyers in 2025?

The main challenge is low inventory for single-family homes and high borrowing costs. Buyers are competing in a market with fewer listings while managing higher monthly payments.

Low supply of homes

Rising mortgage rates

Competitive offers still common

12. Are Los Angeles home prices expected to drop in 2025?

Not significantly. Single-family homes remain strong due to supply shortages. Condos may see slight price adjustments, but overall prices are expected to stay elevated.

Single-family: Prices remain high

Condos: Possible small dips

Overall: No major crash predicted

13. How do Los Angeles housing trends compare to Orange County?

Both markets are similar, but Orange County tends to be pricier for single-family homes. LA has more diversity in pricing and inventory, especially with condos.

LA: More condo options, broader price ranges

OC: Higher single-family home costs

14. Is now a good time to buy in Los Angeles?

It depends on what you’re buying. If you’re going for a condo/townhome, you may find good deals in 2025. If you’re set on a single-family home, expect competition and higher prices.

Good time for condo/townhome buyers

Single-family: competitive and costly

Long-term: real estate still strong

15. Why is Los Angeles considered a hyper-local housing market?

Because each neighborhood behaves differently. County-wide data is useful, but actual prices, demand, and appreciation vary a lot depending on location.

Westside vs Valley: very different pricing

Coastal vs Inland: different buyer demand

Local data = best decision-making tool

16. How are home prices trending in Los Angeles this year?

Home prices in Los Angeles remain high, though growth has slowed. The median home price shows small month-to-month shifts, while buyers watch interest rates closely. Rising mortgage rates continue to affect affordability and monthly payments.

17. What factors are driving housing market dynamics in Southern California?

The housing market in Southern California is shaped by several elements:

Mortgage rates and overall interest rate policy from the Federal Reserve

Housing supply and the unsold inventory index

Consumer confidence and broader economic signals such as the stock market

Regional differences across Los Angeles County, Orange County, and the Inland Empire

18. How does Los Angeles compare to other California housing markets?

The Los Angeles housing market has unique pressures compared with the Bay Area or San Diego. While the Bay Area shows sharper price cuts, Los Angeles has steadier home values. San Diego County and Orange County see similar affordability challenges but smaller active listings pools.

19. What is happening with home sales volume in Los Angeles County?

Home sales volume has dropped compared to last year. Higher interest rates and affordability index pressures have slowed activity. Many single-family home sellers face longer market times, while buyers hesitate due to rising monthly costs.

20. How are mortgage rates shaping the Los Angeles housing market?

Mortgage rates have a direct effect on affordability and monthly payments. When rates rise, fewer buyers qualify for loans. This lock-in effect discourages homeowners from selling because their current loan is cheaper than new borrowing costs.

21. What role does housing supply play in today’s real estate trends?

Housing supply remains tight in the Los Angeles Metro Area. Limited construction starts and slow permitting keep active listings low. The unsold inventory index shows a shortage of homes compared with demand, keeping market dynamics competitive.

22. How do median price changes reflect buyer demand?

The median price and median sales price are strong indicators of buyer activity. When prices rise faster than median household income, affordability weakens. Price reductions are becoming more common in some ZIP codes, signaling softer demand in certain neighborhoods.

23. Are bidding wars still common in Los Angeles real estate?

Bidding wars have cooled compared with the peak years. However, they still appear in coastal areas and neighborhoods with limited housing supply. Properties near strong school districts or close to public transit can still attract multiple offers above purchase price.

24. How do monthly costs affect first-time buyers in Los Angeles?

Monthly costs extend beyond the purchase price. Buyers must factor in:

Mortgage payments driven by current interest rates

HOA fees for condos and townhomes

Property taxes based on home values

Rising housing costs in utilities and insurance

These costs lower the housing affordability index for many entry-level buyers.

25. What is the outlook for the Los Angeles housing market in 2025?

Market data suggests a cautious year ahead. Home values may grow slightly, but affordability pressures remain. The California housing market forecast points to slow improvement if interest rates stabilize. Buyers should buy smart, and sellers need to sell strategically in this environment.